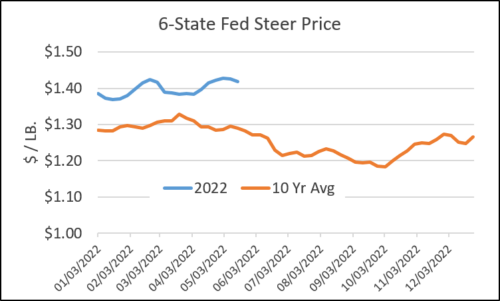

In the past 10 years, the fed cattle price has declined 6% from the first week of May through the end of June. Under current conditions, this suggests a $135/cwt. price at the end of June. The June Live Cattle contract currently trading at $133/cwt. is a bit oversold and a $2/cwt. discount to the 10-year cash market trend for the period.

The cattle placement pattern beginning in the fourth quarter of 2021 shows the finished cattle supply will start to swell in June and could become a 20,000 head surplus over a year ago. Abundant fed cattle during the summer will keep a lid on market prices until cattle numbers are manageable in the fall.

Current cost of gain projections in the feedlot sector are a moving target with volatility in grains and other feed inputs. Regional cost basis will differ but the recent Focus on Feedlots report from Kansas showed projected steer costs averaging $134/cwt. and heifers at $141/cwt. for April placements. If anything, the projections may have increased in a month’s time.

Tallow prices have increased to the point that many feedlots are either feeding a minimal amount to achieve the most initial benefit (around 1% of the ration), or removing it completely from the diet. Tallow provides two to three times the energy benefit of cereal grains and promotes carcass marbling. Replacement ingredients providing the same benefits are scarce to non-existent.

Costs of gain running very near the projected fed cattle price suggest that feedlot managers may opt to market cattle on time or early with respect to their optimum finished date rather than push cattle further out toward a declining market and burdensome cattle supplies.

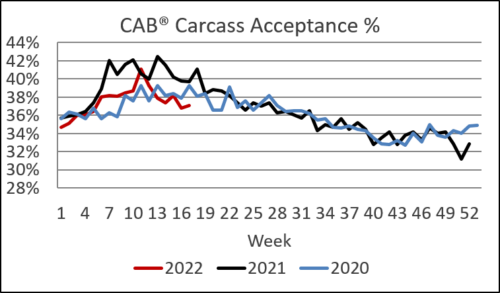

Higher feed costs and challenging summer breakevens may cause carcass outcomes to continue underperforming specific to marbling and premium beef production. We have noted the smaller Prime grade percentage since the beginning of the year, down 1.2 percentage points (ppt.)—an almost 10% drop in Prime carcass tonnage. Similarly, the Premium Choice marbling shortfall is pulling certified carcass counts 2.5 ppt. lower for the CAB® brand since the middle of February.

The recent downtrend in cutout values is indicative of a boxed beef market that needed to adjust lower to meet consumer demand. Consumer appetites for beef have likely not wavered, given the strong demand signals we’ve observed through the end of 2021. However, inflationary price pressure has reached the grocery aisles and consumers are not as enthusiastic to buy beef at recent price levels.

The pace of fed cattle slaughter has been strong and packers have a positive profit margin to work from, although smaller than in many recent months. This has incentivized the weekly slaughter pace, but boxed beef inventory is slower to move at this point, prompting price reductions and encouraging buyers to step in to the market. With Memorial Day just ahead, it appears that renewed buying interest from retailers will create some lift in the market and spot market activity.

Middle meat items such as ribeyes, strip loins and tenderloins are reflecting the market pressure with notable downward price moves in the past few weeks. Similarly, flat irons have seen a steep downward price trend from wildly inflated price points relative to other cuts. Brisket prices typically spike this time of year but have fallen 13% since mid-April in a counter-seasonal move.

End product price spreads for high quality carcasses began to widen in last week’s data. The Prime cutout advanced $5.90/cwt. in five weeks to average $31.90/cwt. higher than Choice last week. The CAB® (traditional) cutout premium to USDA Low Choice advanced $1.40/cwt. in the past month to average $14.50/cwt. while the Choice/Select spread is up to $14/cwt. These price spreads should continue to widen if carcass quality grade trends continue to underperform.

###

Certified Angus Beef