by Katie Micik, DTN Markets Editor

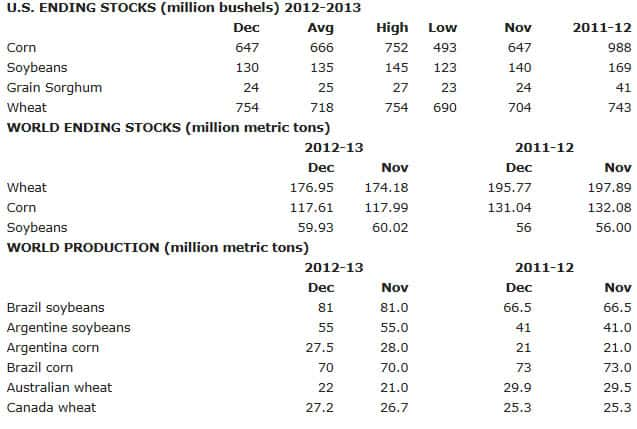

WASHINGTON (DTN) — USDA increased its estimate of U.S. and global wheat ending stocks, citing higher production estimates in Australia and a slowdown of U.S.-origin exports, while making only small tweaks to corn and soybean ending stocks numbers.

USDA trimmed Argentina's corn production estimate from 28 million metric tons to 27.5 mmt, reflecting acreage cuts due to delayed planting. It left Brazilian estimates unchanged. South American soybean production estimates were also left unchanged.

World Agricultural Supply and Demand Estimates (WASDE) link: http://www.usda.gov/…

Crop Production report link: http://usda.mannlib.cornell.edu/…

CORN

U.S. ending stocks were left unchanged from November's estimate at 647 million bushels. The trade was expecting a small increase. The stocks-to-use ratio held steady at 5.8{8a1275384cb93b18aa3d41af404144e37302a793dec468d70d54c97b65cfac05}.

USDA did make some interesting changes globally. China's corn production came in at a record, up 8.0 mmt, but that production bump was largely offset by an increase in global feed use, putting ending stocks at 117.61 mmt. That resulted in a small decrease in the global stocks-to-use estimate to 13.6{8a1275384cb93b18aa3d41af404144e37302a793dec468d70d54c97b65cfac05}.

SOYBEANS

USDA cut U.S. soybean ending stocks 10 mb to 130 mb, citing an increase in domestic crush. The move trimmed the stocks-to-use ratio to 4.3{8a1275384cb93b18aa3d41af404144e37302a793dec468d70d54c97b65cfac05} from 4.6{8a1275384cb93b18aa3d41af404144e37302a793dec468d70d54c97b65cfac05} in November.

Globally, soybean ending stocks for 2012-13 were cut by less than 0.09 mmt to 59.93 mmt. South American production estimates were left unchanged. The stocks-to-use ration fell from 23{8a1275384cb93b18aa3d41af404144e37302a793dec468d70d54c97b65cfac05} to 22.9{8a1275384cb93b18aa3d41af404144e37302a793dec468d70d54c97b65cfac05}.

WHEAT

In wheat, U.S. ending stocks were increased by 50 mb, reflecting the slow pace of exports so far this year. Ending stocks were estimated at 754 mb. USDA projected a 45 mb cut in hard red winter wheat exports, 10 mb for soft red winter wheat and 5 mb for hard red spring wheat. White wheat export estimates increased 10 mb. The stocks-to-use ratio increased from 28.9{8a1275384cb93b18aa3d41af404144e37302a793dec468d70d54c97b65cfac05} in November to 31.6{8a1275384cb93b18aa3d41af404144e37302a793dec468d70d54c97b65cfac05} this month.

Globally, China also had large wheat production and USDA raised its estimate for the 2012-13 production by 2.6 mmt. Australia and Canada's production estimates were also increased by 1 mmt and 0.5 mmt respectively. The production increases led to a global ending stocks figure of 176.95 mmt with a stocks-to-use ratio of 26.3{8a1275384cb93b18aa3d41af404144e37302a793dec468d70d54c97b65cfac05}.

ANALYSIS

The only bullish changes in the U.S. report numbers Tuesday morning were for soybeans, said DTN Contributing Analyst Elaine Kub. “But this has lent support across the grain sector at the start of the extended session. By bumping domestic crushings up by 10 million bushels, USDA's total use projection went up, and the U.S. ending stocks number fell by an equivalent amount. At only 130 million bushels, that ending stocks figure is lower than the average pre-report estimate.

“The corn supply and demand table was left completely unaltered since November. For wheat, USDA trimmed their 2012/13 export projection by 50 million bushels, bearishly raising the domestic ending stocks projection to the high end of pre-report expectations. Correspondingly, Chicago wheat futures reacted by falling more than 10 cents.” Kub said.

Indications from world ending stocks were overall mixed, with slightly bullish cuts made to both the world soybean and world corn situation, Kub said.

“Meanwhile, world wheat ending stocks projections were bearishly raised by 1.5{8a1275384cb93b18aa3d41af404144e37302a793dec468d70d54c97b65cfac05}. Traders were closely watching to see if USDA would cut Argentina's planted corn area and subsequent production, and it did, although that move had a rather slight effect on the final ending stocks number once other countries' production increases are considered. Similarly, Argentina's projected soybean crop was also trimmed.

“In aggregate, the report's changes may not be surprising enough to traders to lend much overall momentum to the grain and oilseed futures markets.”

© Copyright 2012 DTN/The Progressive Farmer. All rights reserved.

Posted with DTN Permission by Haylie Shipp