Sorting through today’s news and determining what it means for tomorrow’s prices is a challenge for all participants in the grain industry. There are plenty of tools to help with decision making, but the volatility experienced in 2022 may be embedded for the near future. Talk of a global recession may soften commodity prices initially, but just as quick, geopolitics can reverse any downward trend as we’ve seen the last two weeks.

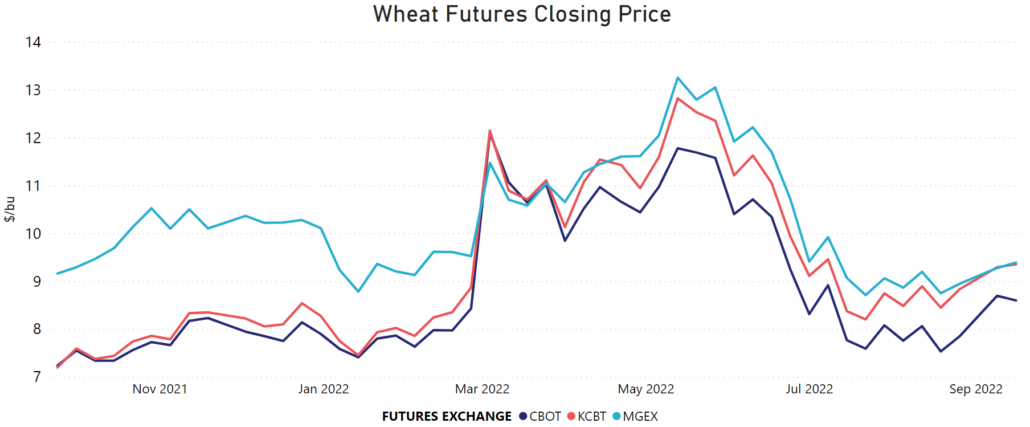

Volatility seems to be the new normal in global wheat markets. U.S. wheat futures prices over the past year clearly demonstrate that condition.

Global Supply

The global balance sheet for wheat is down 10.0 MMT in 2022/23 compared to 2021/22 at 1.06 billion metric tons (MT). Beginning stocks this season are the lowest since 2017/18 while ending stocks are expected to be the tightest since 2016/17. Despite Russia’s huge wheat crop and rebounds in production for both the U.S. and Canada, reductions in the European Union (E.U.), Argentina, and Ukraine are helping to keep prices firm.

U.S. wheat production is up this year, but only slightly, increasing from 1.64 million bushels to 1.65. According to USDA’s just released Small Grains Summary, production for all classes of U.S. spring wheat increased this year but winter wheat production was lower.

Drought forced Hard Red Winter (HRW) wheat production down 29% this year. Incentives for double-cropping wheat and soybeans helped to prevent Soft Red Winter (SRW) wheat production from falling as much, down just 6% in 2022. Spring wheat production increased this year, more a result of substantially improved moisture conditions for many spring wheat growing areas. White wheat production was up 41%, Hard Red Spring (HRS) wheat up 46%, and Durum wheat production up 73%.

The September Grain Stocks report found U.S. wheat supplies up less than 1% from a year ago.

On-farm stocks are estimated at 591 million bushels, up 41 percent from last September. Off-farm stocks, at 1.18 billion bushels, are down 13 percent from a year ago. The June – August 2022 indicated disappearance is 543 million bushels,

down 24 percent from the same period a year earlier.

Black Sea Grain Corridor

Russia’s invasion of Ukraine has had the biggest effect on upending the global wheat market. The United Nations brokered an agreement to establish a grain corridor in the Black Sea. As a result, Ukraine has shipped more than 7 MMT of grain since July, when the agreement was signed according to APK. However, Putin’s criticism of the grain deal and escalation of the war on his neighbor have once again roiled markets and sent futures higher.

The multilateral agreement establishing the grain corridor will expire in November. Given the Russian president’s unpredictable actions so far, there is no guarantee that the agreement will be renewed.

Russian Potential

Russia has produced one its largest wheat crops ever. The USDA forecasts Russian wheat production at 91 MMT this month while the European Union’s crop monitoring service, MARS, projects the Russian wheat crop will total 95 MMT. The USDA predicts exports could reach 42 MMT. But Russian exports so far this season have been slow to move. According to IKAR, a Russian analyst, Russian wheat exports are expected to reach 4 MMT in September, well behind the 4.7 MMT exported a year ago. Russian wheat exports are not under any western backed trade sanctions, but shipping companies, insurers, and banks are still cautious to do business with Russia.

Additionally, heavy rain in the central and southern areas of the country is delaying plantings. SovEcon reported that 8.6 million hectares (21.2 million acres) of grain had been sown so far, 1.5 million hectares (3.7 million acres) behind their pace a year ago. The consultancy added that it’s the lowest area planted since 2013.

Dependability of Supply

India also played its hand in driving global wheat futures higher. After initial pronouncements of feeding the world’s hungry, India quickly reversed course and blocked wheat exports. The country is expected to instead import 25,000 MT of wheat this year.

Input Costs

High gas prices could affect access to nitrogen-based fertilizers. Yara International, a Norwegian-based fertilizer producer warned that the gas situation in Europe could create shortages and add to risk. Gas prices on the continent have risen 45% since June when Russia curtailed shipments following E.U. sanctions. Yara said it expects to pay $1.1 billion more for natural gas in the third quarter than a year ago. Natural gas is a key ingredient for making nitrogen-based fertilizers.

U.S. Dollar Value continues to rise against many different currencies, affecting the cost of dollar denominated wheat trade. In such an uncertain global wheat market, even minor changes in the dollar index are adding volatility.

The Rising U.S. Dollar

Overall, the U.S. Dollar (USD) continues to strengthen. Yet in this environment even subtle changes up or down in USD value can move U.S. and global wheat prices.

There is no shortage of headlines that directly affect the global wheat market. It is tough to say how much the road will curve in the near term. Grain buyers will remain busy absorbing the headlines as fast as they come.

Wheat Demand to Grow

Despite questions about acreage and production, U.S. wheat continues to be in demand by international customers because of its consistent quality and reliability.

Mike Krueger, a grain industry consultant with Lida Communications, expects the demand will continue to expand.

“A primary reason is that global wheat supplies are likely to shrink due to a renewed focus on soybeans, and to a lesser extent, corn,” Krueger said. “Another factor favoring U.S. producers involves shipping and logistics limitations that hamper competing wheat-growing countries, including Russia and Ukraine.”

Effects from a third consecutive La Nina would further pressure global supplies.

“These things will undoubtedly lead to more export demand for wheat,” Krueger said. “Can the U.S. meet the demand? That is the puzzle that’s still being put together. Farmers make decisions every single planting season. They only have so many acres to work with.”

###

U.S. Wheat Associates