With baby calves running around many spring-calving operations there’s probably little thought to fall feeder calf markets for this majority of cow-calf producers. Still, recent bullish direction in cattle futures urges a degree of optimism looking ahead to marketing the new calf crop.

With this said, feedyard ration costs are the limiting factor in current breakeven calculations. The corn price rally that began last August has taken dry matter ration costs from the $200/ton range to upward of $300/ton range, with lots of variables depending on timing and circumstances in the future. Today’s information looking ahead as far as next fall suggests using a ration cost of $300 to $320/ton in calculations.

The April 2022 Live Cattle contract this Tuesday was quoted at $132/cwt., a price that hasn’t been reached since the $136/cwt. value seen in June 2017. This is not to suggest that we limit upside expectations, prices could move higher, but this a respectable price given what we’ve experienced in the past three years.

Marketing the spring 2021 calf crop when the calves are just weeks old is possibly a bit aggressive in an up-trending market, but let’s take a look at a breakeven projection as an exercise of awareness.

Using one of the more favorable examples, we’ll look at 650 lb. steers delivered in October with an expected finish date in April 2022. Further feedyard performance assumptions include 3.6 lb. average daily gain at 6-to-1 dry matter feed conversion.

If taken to a shrunk finished weight of 1,380 lb. with an average of 1.5% death loss, then the total cost of gain lands near $1.08/lb. The finishing date is at the end of April, so it’s fair to acknowledge that likely one-third of the pen will fall in the May market. If sold in the weekly cash market, the math suggests a breakeven purchase price of $156.38/cwt.

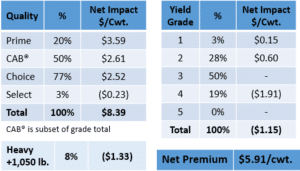

Grid marketers have a bit more figuring to do. A good, but not exceptional, set of Angus steers might achieve the carcass results seen in the table below. Given 203 days on feed and an average backfat thickness of 0.65 inches, the proposed yield grade outcomes and estimate of 8% of carcasses over 1,050 lb. (heavies) are logical.

Using this week’s USDA grid premiums and discounts report, the net adjustment to the carcass price is +$5.91/cwt. Converted to a live price the premium is $3.74/cwt. or $51.70/head.

Feedyard operators are privy to more details fitting their own circumstances but cow-calf operators may find the grid calculations helpful. That $51.70/head premium backed up to the weaned 650 lb. steer price is a $7.95/cwt. increase above the commodity market average.

The futures-implied 650 lb. steer price given the above assumptions suggests a $156.38/cwt. breakeven purchase price for the October delivery. Updating the math with the accompanying grid premiums and discounts implies a $164.33/cwt. purchase price after premiums.

Capturing the premium at weaning, after backgrounding or selling the finished steers requires planning and dedication to marketing. Results are widely variable.

####

Certified Angus Beef – 2021