by JM Peck

CI-121 is a ballot initiative with the goal of limiting or capping residential property taxes increases. Over the last year I have been concerned by rising inflation and increased property values but this initiative misses the mark on addressing any of these issues. No one likes paying taxes but they are necessary. Unfortunately, Montana’s tax codes are complex but this constitutional change will only muddy the water further.

The Montana Constitution states that, “taxes shall be levied by general laws for public purposes”; not through constitutional initiative. Our property taxes fund our local schools, local roads, local law enforcement and even our cemeteries. Tax policy should be managed through the legislative process, not a change to our Montana Constitution. It is fiscally unwise to reduce or cap taxes without reducing or capping spending. We need dynamic tax policies to address the needs of our citizens, communities and state and we must demand that from our leaders and legislators.

Passing and implementing this initiative would negatively impact our local communities and it would shift the burden to other property types like farms and ranches and other small businesses.

In Southwest Montana, we are proud of our agricultural heritage and the high-quality products we produce. This initiative could shift much of our local tax burden to our family farms and ranches. It is the residential growth and migration to our rural areas that are putting the most strain on our local services. The ag sector is not growing at the rate that our population is and will not be able to keep up with the increased demand for schools, roads and other necessary services. Economic growth is a key component of a vibrant rural community and this initiative could hurt growth while benefiting out-of-state interests.

When it comes time to decide on this issue, please think about how this measure will affect our schools, roads and your neighbors. Our tax systems need to be constantly reviewed and we should always push our leaders to make sure the dollars we send are being spent efficiently and on things our communities need and rely on. This initiative does not accomplish any of that and puts our rural communities at risk. It is simply a “rob Peter to pay Paul” situation that will hurt hard working Montanans and small businesses. Say no to CI-121.

###

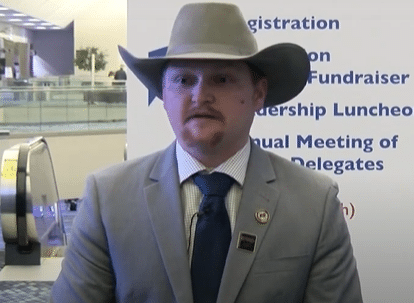

JM Peck is a cattle rancher from Melrose, MT. He currently serves as Chairman of the Montana Farm Bureau Federation’s Young Farmer and Rancher Committee.