It is no secret that wheat futures prices have reached unexpected heights recently. Higher futures prices usually pressure export basis values when farmers sell wheat “into the rally” because that increases exportable U.S. wheat supplies.

However, we are seeing a completely different phenomenon in the recent market. Extremely tight elevation capacity out of the Gulf and Pacific Northwest (PNW) due to massive U.S. agricultural commodity exports to China is sustaining high wheat export basis values, despite increased farmer selling.

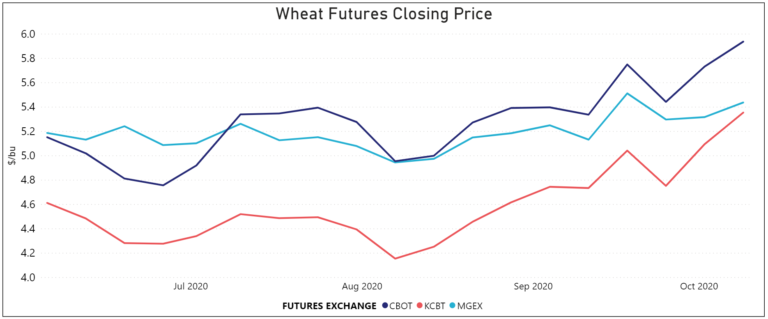

Soft red winter (SRW) futures and hard red winter (HRW) futures, specifically, have jumped over the past month beyond expected levels. Between Aug. 10 and Oct. 15, for example, SRW futures prices increased 24 percent to $6.18/bu, the highest since December 2014. Over the same period, HRW future prices jumped 31 percent to $5.58/bu, the highest since August 2018. Hard red spring (HRS) futures have increased too, by 10 percent since Aug. 10 to close at $5.58/bu on Oct. 15.

U.S. grain traders agree generally that the “run up” in futures prices is attributed to technical buying, where “managed money” or commodity funds buy significant amounts of U.S. wheat futures contracts with the expectation that the contracts will gain value over time. While not the whole story, part of this technical buying spree can be attributed to varying severities of dryness from Argentina to the U.S. Great Plains to the Black Sea.

These high export basis levels could hold on. “Increased farmer selling hasn’t made a dent on export basis,” said one grain trader. That is because China has purchased 1.48 MMT of wheat for delivery in 2020/21, as of Oct.1.

U.S. Wheat Associates does not have a crystal ball, based on their information, they expect export basis levels will stay at these higher levels through January assuming Chinese buying remains strong. Futures prices could come down off their recent rally if, for example, “managed money” reverses its long position in wheat futures, but there would have to be a significant downward correction to take pressure off current FOB values.

###

U.S. Wheat Associates