A recent survey by Farm Futures says that farmers are indeed responding to the current price environment and intending to plant more winter wheat this fall and way more soybeans next spring.

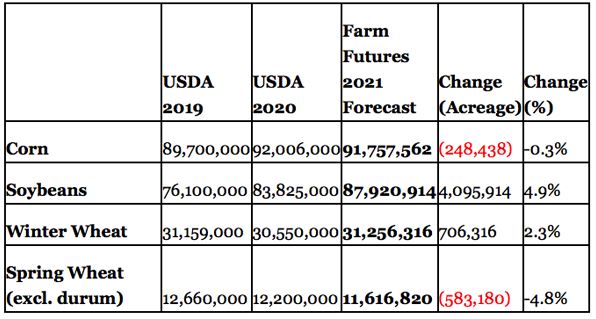

For most of the last decade, planted wheat acres have continued to fall but farmers are ready to buck that recent trade. In the survey that took place in August, respondents indicated a shift from spring wheat acreage over to winter wheat. If realized, a higher 2021 winter wheat acreage would reverse seven consecutive years of shrinking winter wheat acres. Durum was excluded from the results due to a limited response rate, but other spring and winter wheat acreage is predicted to total 42.7 million acres in 2021, up 0.3% from 2020.

A lower dollar and increased consumer demand for pasta and flour amid the coronavirus pandemic reignited both domestic and international attention to U.S. wheat. As international wheat movement increases in the wake of the pandemic, export demand will be critical to supporting wheat prices and by extension, wheat acreage.

Just over a quarter of the way into the 2020-2021 marketing year, wheat export sales are beating the previous year by almost 7% with 482 million bushels exported. Mexico, the Philippines and Japan remain the top 3 foreign markets for U.S. wheat.

For the row crops, the survey found that farmers across the country are eager to plant more soybeans next year. In the last 6 weeks, soybean prices have jumped 17% and are now above $10/bushel. Respondents projected planting over 4 million more acres of soybeans next spring, totaling just shy of 88 million acres. If that rings true, soybean acreage in 2021 will be the third highest on record.

Farm Futures says that market incentives justify that move. The current new crop soybean to corn price ratio strongly favored soy acreage over corn throughout this summer. Chinese soy demand soared higher in late May as the world’s second largest economy began booking orders for new crop soybeans.

With Brazilian exportable supplies heavily depleted as soybean harvest approaches in the U.S., soybeans may find enough favor in international channels this winter to justify a nearly 5% increase in soybean acreage next year.

That’s not to downplay the performance of corn prices here in late summer. Corn futures have increased almost 16% in value since early August and are starting to push against that 4 dollar mark. At the time of this writing corn futures are at their highest levels since March 13th.

The recent rally may play into the fact that respondents to the survey indicated they would plant a similar number of acres to corn in 2021. Corn is still expected to be the most widely grown commodity in the country with a drop of just 0.3% in acreage. While ethanol and livestock demand have struggled to break through pandemic plateaus, farmers are predicted to plant 91.8 million acres of corn next spring. Given favorable planting and growing conditions, 2021 could be a chance for farmers to sow record-setting corn yields and volumes as demand continues to recover amid the pandemic.

###

Farm Futures/Northern Ag Network