The US Department of Agriculture’s National Agricultural Statistics Service (NASS) recently released their annual farmland value estimates for 2020. The NASS estimates are derived from a survey, administered each June, in which farm operators are asked to estimate the market value of their land. For states with property transaction price non-disclosure rules, such as Montana, the NASS estimates represent one of the only publicly available sources of farmland value estimates.

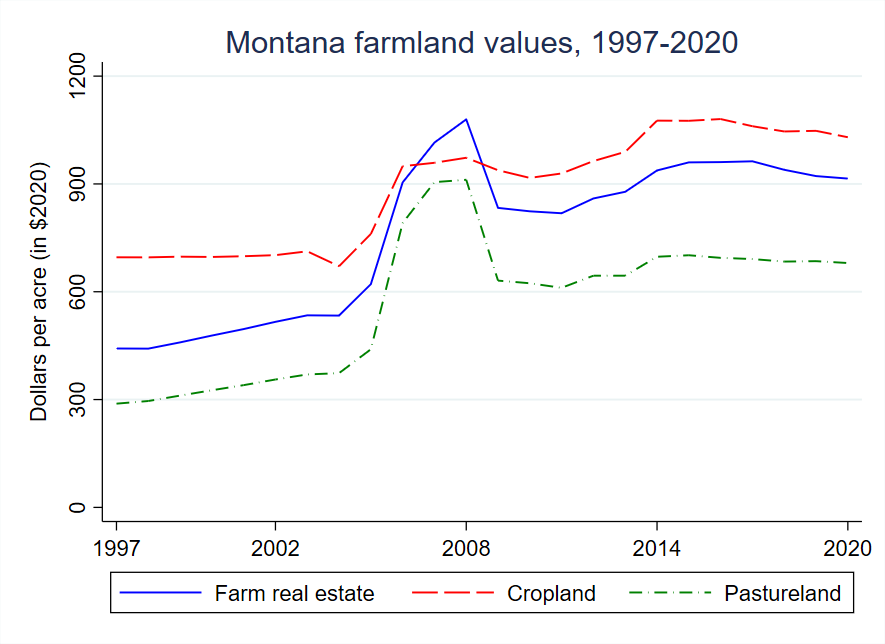

Per the latest survey, the value of farm real estate (land and buildings) in Montana remained at $915/acre, the same value reported for 2019. After adjusting for inflation using the Bureau of Economic Analysis’s GDP Implicit Price Deflator series, the flat trend in nominal farm real estate value amounts to a real decline of $7/acre (or 0.75%).

The real value of cropland ($1030/acre) in the state moved downward by roughly $18/acre (1.70%), continuing a modest decline after a 2016 peak ($1081/acre). Similarly, real pastureland value decreased by $5/acre (0.75%) to $680/acre. All told, the NASS report points to a modest decline in the value of Montana’s farmland over the past year. For all three farmland value measures, the 2020 estimates represent the lowest real values observed since 2013.

Sources: US Department of Agriculture-NASS, QuickStats and Bureau of Economic Analysis (via Federal Reserve Economic Data)

For the US as a whole, the NASS figures indicate no change over the past year in the nominal values of all three farmland variables, which again represent small inflation-adjusted declines. The coronavirus pandemic and trade war with China have hit some sectors of the farm economy particularly hard (e.g., dairy, corn, and soybean producers), putting downward pressure on current farmland returns and, by extension, land values. Widespread drought in the western US represents another factor that would be expected to have a negative impact on the current returns to farmland.

However, it is worth remembering that farmland is an asset, and its value therefore capitalizes both the current and expected future returns to land. To this end, signals from the Federal Reserve that interest rates will remain low for some time provide a counterweight to the aforementioned negative influences and buoy the value of land. In addition, government policy providing relief to farmers amid the pandemic and trade war has counteracted, at least in part, observed declines in land returns.

Relatively flat trends in national measures mask considerable variation across states. Midwestern states, on the whole, saw declines in most farmland value categories. Iowa, Kansas, and South Dakota were among the states with the biggest drops in farm real estate value. Cropland value declined by more than $100/acre in Iowa, South Dakota, and Wisconsin. In relative terms, Kansas saw a 4.43% cropland value decline, the largest of any state. Wisconsin also experienced one of the more substantial declines in pastureland value ($77/acre; 3.33%), as did Indiana and North Dakota. Midwestern grain producers have been negatively impacted by the ongoing trade war with China, as well the decrease in ethanol demand due to changing driving patterns as a result of the pandemic. Dairy prices have also continued to trend downward, hitting states like Wisconsin particularly hard.

A number of states in the Southeast and Southern Plains, on the other hand, experienced record high levels of farmland values. This includes Texas, which has seen strong demand stemming from recreational and investment interests. Despite the ongoing drought throughout much of the western US, Idaho, Colorado, and Oregon also fared especially well, with cropland values bolstered by record-high values for irrigated land.

Farmland values are often used as a barometer for the overall health of the US farm sector, and the latest NASS report represents a mixed bag of both positive and negative news for farmland owners. In recent years market analysts have predicted that a downward correction in farmland values is on the horizon. With aggregate state-level data, however, it is difficult to tease out the role played by financial and market fundamentals in the latest set of data points, especially given the uncertainty surrounding a number of farm sector influences.

Written by Dan Bigelow – Assistant Professor in the Department of Agricultural Economics and Economics at Montana State University. Find more at AgEconMT.com.