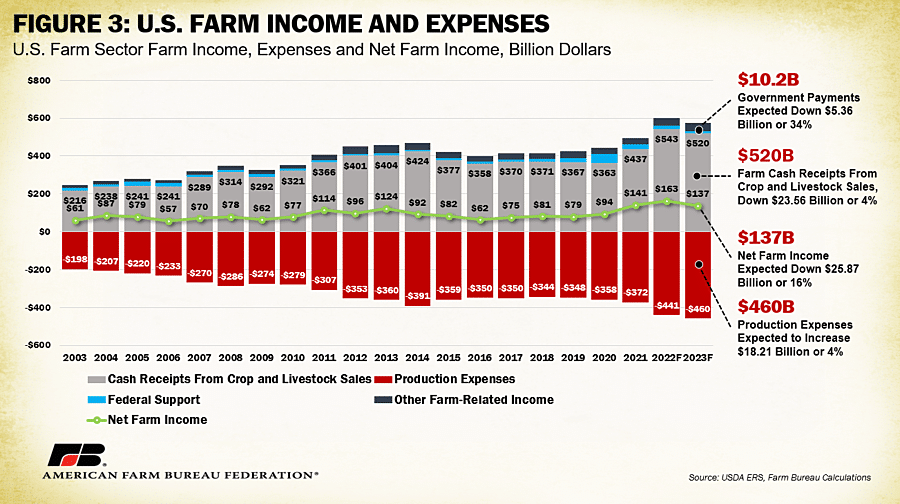

USDA’s Economic Research Service expects 2023 farm incomes to decline nearly 16% compared to 2022 due to lower cash receipts, smaller government payments and higher production expenses.

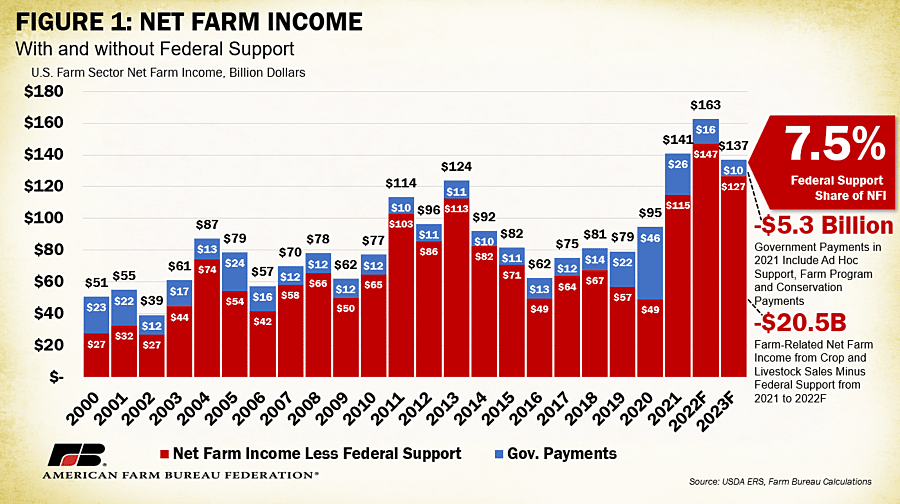

U.S. net farm income, a broad measure of farm profitability, is currently forecast at $136.9 billion, down 15.9% from 2022’s $162.7 billion. This $25.9 billion decline erases the $21.9 billion increase that was forecast between 2021 and 2022 but is smaller than the gain between 2020 and 2021 of $46.5 billion following the COVID-19 pandemic.

When adjusted for inflation, 2023 net farm income is expected to decrease $30.5 billion (18.2%). The report expects farm and ranch production expenses to continue to increase by $18.2 billion (4.1%) in 2023 to $459.5 billion, following a record increase of $70 billion in production expenses in 2022.

CASH RECEIPTS

Overall cash receipts are expected to decline by $23.6 billion, or 4.3%, from 2022. The largest decrease in net farm income is tied to a projected fall in cash receipts from livestock due to lower prices for all major categories except cattle.

Chicken eggs and milk are responsible for the largest percentage decreases, with cash receipts for chicken eggs projected to decrease by $4.9 billion or 24%. Highly pathogenic avian influenza has affected over 52 million birds in commercial flocks in the U.S., including over 43 million egg layers, pressuring supplies and pushing up prices. As the flock recovers, egg production increases and consumer demand fundamentals recalibrate prices lower. Milk receipts are similarly expected to decline $8.4 billion (14.6%) on expectations for higher milk production and lower corresponding prices.

Cash receipts for cattle and calves are estimated to increase by $2.1 billion or 2.4%. Drought conditions in the West and Southern Plains have damaged pastures and led to higher costs for feed such as hay. This has resulted in many farmers marketing heifers that would typically be kept for breeding and herd replacement and thus a reduction in U.S. cattle inventory that will continue for years to come. Tighter cattle supplies have pulled both cash and futures prices higher, leading to continued growth in cash receipts.

On the crops side, receipts for major row crops like corn and soybeans are expected to decline while wheat and hay are expected to increase. Receipts for corn are expected to fall by 4.5% ($4.1 billion), while soybeans are expected to be down 8.1% ($5.2 billion). Wheat is expected up 4% ($0.6 billion) and hay receipts are expected to grow by $0.6 billion (6.1%).

The vast majority of expected receipt declines are linked to falling prices rather than volume dynamics. Weather and climate conditions will have strong impacts on the true outcome of this year’s price outlook. Extreme drought that has pushed up hay and wheat prices could subside marginally if moisture conditions improve. Record production in foreign corn and soybean players like Brazil and Argentina are competition for U.S. crops overseas, particularly in China.

PRODUCTION EXPENSES

Farm sector production expenses, which include operator dwellings, are expected to increase by $18.2 billion from 2022 to $459.5 billion in 2023. While that sets a record in nominal dollars, it remains below 2014’s record high when adjusted for inflation.

“Most of the production expense categories are projected to remain above their 2021 levels in 2023, in both nominal and inflation-adjusted dollars,” USDA said.

Feed costs remain the biggest line item at $72.7 billion. Although that’s $3.9 billion less than 2022, it comes on the heels of an $11.3 billion increase in the prior year.

Fertilizer, lime and soil conditioners are the second-largest expenses category at $42.2 billion, just shy of 2022’s record high of $42.5 billion.

USDA notes considerable increases in farmers’ interest expenses, up more than 22% from the year before, as well as labor costs, which are expected to grow 7% from 2022.

Fuel and rent expenses are expected to decline in 2023. Fuel expenses are projected to fall nearly 15% to $3 billion due to lower U.S. Energy Information Agency forecast diesel prices. USDA says net rent is expected to decline $1.6 billion, or 8.2%. “If realized, this decline would be the first reduction in net rent since 2018 and, in part, reflects the forecast decline in net income.”

GOVERNMENT PAYMENTS

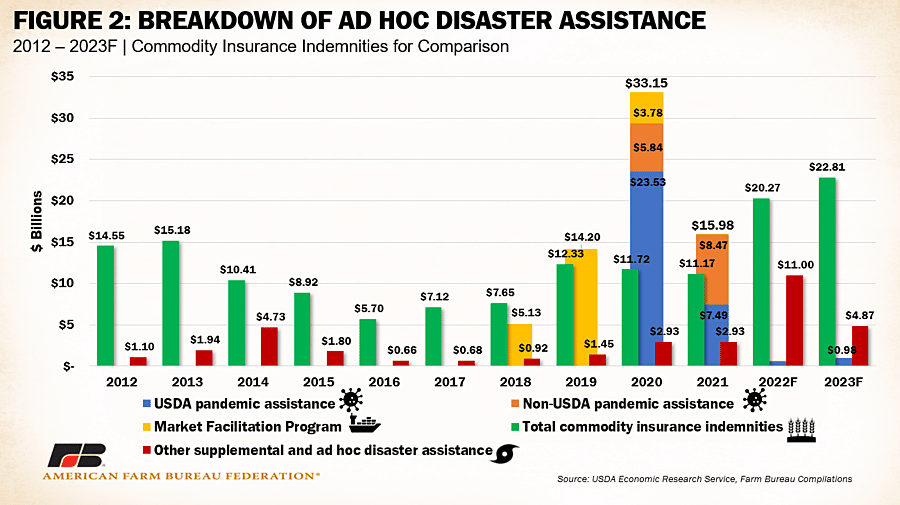

At $10.2 billion, government payments are anticipated to be 34.4% lower than 2022 due to lower supplemental ad hoc disaster assistance. These payments include farm program payments, such as the Agricultural Risk Coverage (ARC) program and Price Loss Coverage (PLC) program but exclude USDA loans and insurance indemnity payments made by the Federal Crop Insurance Corporation.

USDA noted that government payments hit a record high of $45.6 billion in calendar year 2020, before declining to $25.9 billion in 2021 and $15.6 billion in 2022. Much of this is due to lower payments from COVID-19-era programs, such as the Coronavirus Food Assistance Program (CFAP), the Paycheck Protection Program, the Emergency Relief Program and the Emergency Livestock Relief Program.

Conservation program payments are expected to total $4 billion in 2023, up nearly half a million dollars from the previous year.

Farm bill commodity program payments under ARC and PLC are expected to decline more than 81% from 2022 to $303.4 million due to higher commodity prices.

SUMMARY

USDA’s most recent estimates for 2023 net farm income provide a very early estimate of the farm financial picture. For 2023, USDA anticipates a decrease in net farm income, moving from $162.7 billion in 2022 to $136.9 billion in 2023, a decrease of 16%. Much of the forecasted decline in 2023 net farm income is tied to lower crop and livestock cash receipts, continued increases in production costs and a decrease in ad hoc government support, resulting in an overall decrease of forecast net farm income.

It is important to highlight the early nature of this forecast. In February 2022 USDA forecast that net farm income would decline that year by 4.5%. In the September 2022 update that decline was flipped to a 5.2% increase and in the final December 2022 update this 5.2% increase was pushed to a 13.8% increase. The change in the February and December forecast was the difference between general farm economy income decline and record cash receipts.

Much uncertainty remains related to the ability of farmers and ranchers to cost-effectively access inputs and deal with regional regulatory and weather-related challenges. With an early expectation of revenue declines, which more than erase gains made during 2022, it becomes all the more important for producers to have clarity on rules that impact their businesses’ ability to operate, for producers to have access to comprehensive risk management options and for producers to be given a resounding voice during formulation of vital legislation such as the farm bill, which can either complicate or streamline farmers’ and ranchers’ ability to contribute to a reliable and resilient U.S. food supply sustainably.

###

DTN/AFBF-Market Intel